A Cautionary Tale: When Loyalty Costs More Than Switching

For years, I’ve trusted AA for both travel insurance and breakdown cover—renewing each year on autopilot, assuming loyalty meant fair treatment. That trust hasn’t just been chipped away—it’s been shattered by repeated overcharging from the same company I trusted for years.

Travel Insurance: How It Quietly Tripled

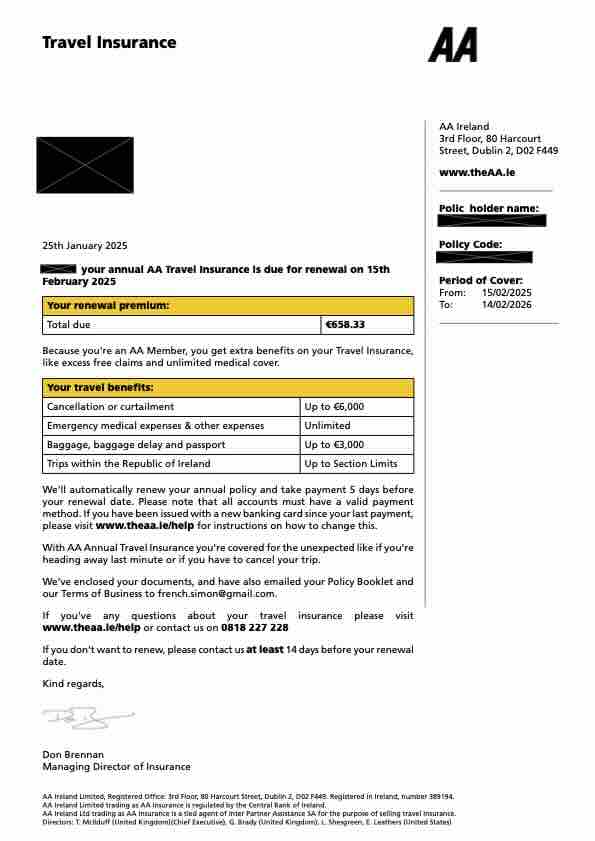

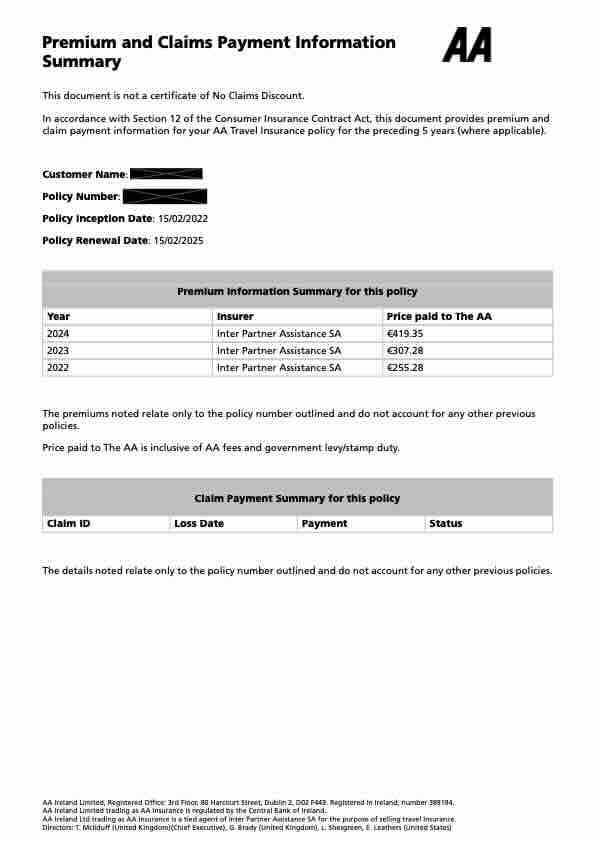

Here’s what I actually paid each year — no claims, no changes in cover, just straight renewals:

- 2022: €255.28

- 2023: €307.28

- 2024: €419.35

- 2025: €658.33

That’s a whopping jump of over 50% from the previous year and €255 to over €650 in just four years. I had no claims, no changes—just shock as the price nearly tripled.

What Made It Even Worse

After seeing the huge jump, I decided to get a fresh quotation from AA for the exact same cover. The new quote was almost identical to the 2022 price! It’s clear that existing customers get charged way more just for sticking with the renewal.

Breakdown Cover Shock

After noticing how much my travel insurance had gone up, I took a closer look at my AA breakdown cover renewal. The same pattern again: steep increases, no added value, and quotes for new customers that were dramatically lower.

When I got a new online quote using identical details, the price dropped by nearly half compared with my “loyal customer” renewal notice. That’s not a fair reward for years of on-time payments—it’s exploitation of complacency.

A Pattern of Loyalty Penalties

- Existing customers are often charged more for identical cover.

- Auto-renewal hides creeping increases until you compare them side by side.

- New quotes often reveal how inflated your “loyalty” price really is.

My Advice

- Don’t ignore your renewal paperwork. Take a minute to check the detail, even if everything “looks fine.”

- Shop around every year. Don’t assume your current provider’s increases are normal.

- Always get a fresh quote before you pay. You might save hundreds—even with the same insurer.

- Ask questions. Challenge price hikes, and see if there’s a better deal by phoning or going elsewhere.

If this dodges even one other person from getting stung as I did, the warning was worth it! Pass this along to friends and family who might not be checking their cover.

Insurance is supposed to bring peace of mind—not quietly empty your wallet.